Tuesday 19 February 2013

Bolivia nationalized the company that runs the three largest airports in Bolivia because the government claims the company did not invest in improving the airports.

real estate company Reyal Urbis filed for insolvency after failing to renegotiate debt with its creditors.

Spain's property market crash claimed another victim on Tuesday, as real estate company Reyal Urbis filed for insolvency after failing to renegotiate debt with its creditors.

The move takes the property developer, which had 3.6 billion euros ($4.8 billion) of debt at the end of September, closer to becoming Spain's second-largest bankruptcy after Martinsa Fadesa, which defaulted on 7 billion euros of debt in 2008.

Dozens of property companies have collapsed in Spain, where house prices have fallen around 40 percent since their 2007 peak. With the country locked in a deep recession, analysts expect prices to fall further still.

Spain's banks were crippled by the property market bust, eventually requiring the state to agree a European bailout for its lenders of almost 40 billion euros last year. Indebted property firms have asked banks for debt relief but patience is wearing thin among lenders saddled with soured property assets.

Reyal Urbis is 70 percent owned by construction magnate Rafael Santamaria and its creditors include Santander, BBVA, Bankia and Banco Popular.

The company, which valued its property portfolio at 4.2 billion euros in June 2012, said it would continue to operate as permitted by Spanish insolvency laws.

Its insolvency petition now goes to court and its fate will be in the hands of a judge.

Reyal Urbis said Santamaria would remain at the helm of the company and he still hoped Reyal Urbis could reach a deal with its creditors, given "the good will of all negotiating parties".

The company had until Feb. 23 to reach a debt restructuring deal with the banks or file for insolvency. Sources close to the matter told Reuters on Friday that creditors had rejected the company's 3.6-billion-euro proposal.

Trading in the company's shares was suspended on Tuesday, Spain's stock market regulator said. The stock had plunged 99 percent since June 2007 to close at 0.124 euros on Monday.

At the end of 2011, Reyal Urbis owned some 888 finished homes in a country where over a million homes lie empty. The company also had 8 million square metres of land for development and 237,000 square metres of commercial property, including offices, shopping centres, industrial property and hotels.

Tuesday 7 August 2012

Jessica Harper admits £2.4m Lloyds Bank fraud

A former Lloyds Bank worker in charge of online security has admitted carrying out a fraud worth more than £2.4m. Jessica Harper, 50, had been accused of submitting false invoices to claim payments between 2007 and 2011. At the time she was working as head of fraud and security for digital banking and made false claims totalling £2,463,750. Harper, of South Croydon, south London, will be sentenced on 21 September. At Southwark Crown Court, Harper admitted a single charge of fraud by abuse of position by submitting false invoices to claim payments. 'A very simple fraud' She also admitted a single charge of transferring criminal property, the money, which she had defrauded from her employers. Harper was arrested on 21 December before being charged in May. Continue reading the main story “ Start Quote Jessica Harper has today been convicted of the type of crime the bank employed her to combat” Sue Patten Crown Prosecution Service Antony Swift, prosecuting, did not open the facts of the case but said it was a "a very simple fraud". He added Harper had already repaid £300,000 and was in the process of selling her house for about £700,000. "That will be some £1m out of £2.5m that's gone missing," he told the judge. Carol Hawley, defending, said: "She appreciates the seriousness and has made full admissions in interview. "She understands perfectly well on the next occasion she will be facing imprisonment of some length." Breach of trust Judge Nicholas Loraine-Smith granted Harper bail on the condition she stays at her current address, obeys a 21:00 to 07:00 curfew and hands in her passport. Sue Patten, head of the Crown Prosecution Service, Central Fraud Division, said: "Jessica Harper has today been convicted of the type of crime the bank employed her to combat. "The evidence in the case was clear and left Harper with little choice but to plead guilty. "In doing so, she has admitted to a huge breach of trust against her former employer." Lloyds is now 39.7% state-owned after being bailed out by the government during the financial crisis.

Shares in Standard Chartered dive after Iran allegations

Shares in Standard Chartered PLC dropped sharply today as investors reacted to US charges that the bank was involved in laundering money for Iran. The charges against Standard Chartered were a shock for a bank which proudly described itself recently as “boring.” Shares were down nearly 20 percent at 1,187 pence at one point in early trading Tuesday on the London Stock Exchange. In Hong Kong, they were down 16.6 percent near the end of the session. New York State Department of Financial Services alleged on Monday that Standard Chartered schemed with the Iranian government to launder $250 billion from 2001 to 2007, leaving the United States' financial system “vulnerable to terrorists.” Standard Chartered said it “strongly rejects” the allegations. In a statement, the bank said “well over 99.9 percent” of the questioned transactions with Iran complied with all regulations, and the exceptions amounted to $14 million. The New York regulator ordered Standard Chartered representatives to appear in New York City on Aug. 15 “to explain these apparent violations of law” and to demonstrate why its license to operate in the State of New York “should not be revoked.” Gary Greenwood, analyst at Shore Capital in London, said the possible revocation of the New York license was of far greater concern than any potential fine, which could run into hundreds of millions of dollars. Standard Chartered's US operation facilitates trade for customers that have operations in both the United States and emerging markets. “Indeed, this is an area of the business that has been highlighted by management for growth,” Greenwood said. “A loss of its US banking license would not only jeopardize part of this profit stream, but the associated reputational damage could also have a severely damaging impact to its operations within emerging markets.” The New York agency alleged that Standard Chartered conspired with Iranian clients to route nearly 60,000 different US dollar payments through Standard Chartered's New York branch “after first stripping information from wire transfer messages used to identify sanctioned countries, individuals and entities.” The New York regulators called the bank a rogue institution and quoted one of its executives as saying: “You (expletive) Americans. Who are you to tell us, the rest of the world, that we're not going to deal with Iranians.” The order also identifies an October 2006 “panicked message” from a London group executive director who worried the transactions could lead to “very serious or even catastrophic reputational damage to the group.” If proven, the scheme would violate state money-laundering laws. The order also accuses the bank of falsifying business records, obstructing governmental administration, failing to report misconduct to the state quickly, evading federal sanctions and other illegal acts. Between 2004 and 2007, about half the period covered by the order, the department claims Standard Chartered hid from and lied about its Iranian transactions to the Federal Reserve Bank of New York. Before 2008, banks were allowed to transact some business with Iran, but only with full reporting and disclosure, the order states. In 2008, the US Treasury Department stopped those transactions because it suspected they helped pay for Iran to develop nuclear weapons and finance terrorist groups including Hamas and Hezbollah. The order states the bank has to provide information and answer questions to determine if any of the funding aided the groups or Iran's nuclear program. Last week, Standard Chartered' chief executive, Peter Sands, boasted that the bank has racked up a 10-year string of record first-half profits “amidst all the turbulence in the global economy and the apparently never-ending turmoil in the world of banking.” “It may seem boring in contrast to what is going on elsewhere, but we see some virtue in being boring,” Sands added.

Friday 6 July 2012

Bankers face the prospect of jail as Serious Fraud Office launches criminal probe into interest-rate fixing at Barclays

Hearing: Former chief executive Bob Diamond left Barclays over the matter, before appearing before MPs this week

A criminal investigation has been launched into alleged rigging of the Libor rate within the banking industry, the Serious Fraud Office (SFO) confirmed today.

SFO director David Green QC formally accepted the Libor issue for investigation after Barclays was fined by the Financial Services Authority (FSA) last week for manipulating the key interbank lending rate which affects mortgages and loans.

The claims ultimately led to the resignation of Barclays boss Bob Diamond and have become the focal point of a fierce political debate over ethics in the banking sector.

The investigation could ultimately lead to criminal prosecutions and bankers facing charges in court.

The SFO's update came after it revealed earlier this week that it had been working closely with the FSA during its investigation and would consider the potential for criminal prosecutions.

The Government department, which is responsible for investigating and prosecuting serious and complex fraud, said on Monday the issues surrounding Libor were "complex" and that assessing the evidence would take time.

Under fire: Barclays former chairman Marcus Agius (right) with former CEO Bob Diamond (centre), and former chief executive John Varley (left)

As the SFO prepares its investigation, Labour leader Ed Miliband continued to push for an independent inquiry into the banking scandal despite MPs rejecting the demands.

The Labour leader said that while the party would cooperate with a parliamentary investigation, its remit was too "narrow" and a judge-led probe was still needed.

Mr Miliband also defended the conduct of Ed Balls after the shadow chancellor engaged in a bitter war of words with his opposite number George Osborne in the Commons.

Tuesday 3 July 2012

Barclays boss Bob Diamond resigns

Barclays chief executive Bob Diamond has resigned with immediate effect. The move comes less than a week after the bank was fined a record amount for trying to manipulate inter-bank lending rates. Mr Diamond said he was stepping down because the external pressure on the bank risked "damaging the franchise". Chairman Marcus Agius, who said on Monday he was stepping down, will take over the running of Barclays until a replacement is found. "I am deeply disappointed that the impression created by the events announced last week about what Barclays and its people stand for could not be further from the truth," Mr Diamond said in a statement. He will still appear before MPs on the Treasury Committee to answer questions about the Libor affair on Wednesday. "I look forward to fulfilling my obligation to contribute to the Treasury Committee's enquiries related to the settlements that Barclays announced last week without my leadership in question," Mr Diamond said. Last week, regulators in the US and UK fined Barclays £290m ($450m) for attempting to rig Libor and Euribor, the interest rates at which banks lend to each other, which underpin trillions of pounds worth of financial transactions. Staff did this over a number of years, trying to raise them for profit and then, during the financial crisis, lowering them to hide the level to which Barclays was under financial stress. Prime Minister David Cameron has described the rigging of Libor rates as "a scandal". The Serious Fraud Office is also considering whether to bring criminal charges.

Thursday 7 June 2012

Bank of England meets amid talk of £50bn stimulus

Bank of England policymakers meet today to decide whether to change interest rates or to pump in more money into the ailing economy, with leading economist saying they may opt to inject a further £50bn of stimulus.

Europe is on the verge of financial chaos.

Global capital markets, now the most powerful force on earth, are rapidly losing confidence in the financial coherence of the 17-nation euro zone. A market implosion there, like that triggered by Lehman Brothers collapse in 2008, may not be far off. Not only would that dismantle the euro zone, but it could also usher in another global economic slump: in effect, a second leg of the Great Recession, analogous to that of 1937. This risk is evident in the structure of global interest rates. At one level, U.S. Treasury bonds are now carrying the lowest yields in history, as gigantic sums of money seek a safe haven from this crisis. At another level, the weaker euro-zone countries, such as Spain and Italy, are paying stratospheric rates because investors are increasingly questioning their solvency. And there’s Greece, whose even higher rates signify its bankrupt condition. In addition, larger businesses and wealthy individuals are moving all of their cash and securities out of banks in these weakening countries. This undermines their financial systems. 423 Comments Weigh InCorrections? Personal Post The reason markets are battering the euro zone is that its hesitant leaders have not developed the tools for countering such pressures. The U.S. response to the 2008 credit market collapse is instructive. The Federal Reserve and Treasury took a series of huge and swift steps to avert a systemic meltdown. The Fed provided an astonishing $13 trillion of support for the credit system, including special facilities for money market funds, consumer finance, commercial paper and other sectors. Treasury implemented the $700 billion Troubled Assets Relief Program, which infused equity into countless banks to stabilize them. The euro-zone leaders have discussed implementing comparable rescue capabilities. But, as yet, they have not fully designed or structured them. Why they haven’t done this is mystifying. They’d better go on with it right now. Europe has entered this danger zone because monetary union — covering 17 very different nations with a single currency — works only if fiscal union, banking union and economic policy union accompany it. Otherwise, differences among the member-states in competitiveness, budget deficits, national debt and banking soundness can cause severe financial imbalances. This was widely discussed when the monetary treaty was forged in 1992, but such further integration has not occurred. How can Europe pull back from this brink? It needs to immediately install a series of emergency financial tools to prevent an implosion; and put forward a detailed, public plan to achieve full integration within six to 12 months. The required crisis tools are three: ●First, a larger and instantly available sovereign rescue fund that could temporarily finance Spain, Italy or others if those nations lose access to financing markets. Right now, the proposed European Stability Mechanism is too small and not ready for deployment. ●Second, a central mechanism to insure all deposits in euro-zone banks. National governments should provide such insurance to their own depositors first. But backup insurance is necessary to prevent a disastrous bank run, which is a serious risk today. ●Third, a unit like TARP, capable of injecting equity into shaky banks and forcing them to recapitalize. These are the equivalent of bridge financing to buy time for reform. Permanent stability will come only from full union across the board. And markets will support the simple currency structure only if they see a true plan for promptly achieving this. The 17 member-states must jointly put one forward. Both the rescue tools and the full integration plan require Germany, Europe’s strongest country, to put its balance sheet squarely behind the euro zone. That is an unpopular idea in Germany today, which is why Chancellor Angela Merkel has been dragging her feet. But Germany will suffer a severe economic blow if this single-currency experiment fails. A restored German mark would soar in value, like the Swiss franc, and damage German exports and employment. The time for Germany and all euro-zone members to get the emergency measures in place and commit to full integration is now. Global capital markets may not give them another month. The world needs these leaders to step up.

Wednesday 23 May 2012

Spain injects €9bn into ailing lender Bankia

Luis de Guindos told the Spanish parliament that the government would do whatever was needed to rescue Bankia, while stressing that the situation “shouldn’t be extrapolated to the nation’s entire banking system”. In what amounted to an attempt to bolster confidence and prevent a run on Spanish banks, he said directors at the nationalised lender would present a plan indicating the level of capital needed to meet all regulatory requirements. Announcing the taxpayer bailout after markets had closed, Mr de Guindos said: “The government will fully back the capital needs which result from this plan.” He said €9bn would cover capital needs of €7.1bn to comply with two banking reforms presented by the government as well as €1.9bn of capital buffers to comply with European-wide rules. Bankia is the country’s fourth-largest lender and was formed in 2010 by merging seven of Spain’s regional savings banks. It has the greatest exposure to toxic property assets.

Loose talk is destroying the euro zone

Europe’s leaders should be more careful about what they say. In a radio interview on Friday, Wolfgang Schaüble, Germany’s finance minister, predicted that the current turmoil in financial markets would last for another “12 to 24 months.” Whether or not this was an off-the-cuff remark is immaterial. There was simply no need for Schaüble, one of the world’s most important policy makers on whose every word the markets hang, to say such things when the euro-zone crisis is spinning out of control. This is not the first instance of misguided comments by Europe’s crisis managers. The most egregious case was the repeated denials during the first year of the crisis that Greece was bankrupt, thereby blurring the line between fundamental problems of solvency and temporary liquidity ones, like those faced by Spain and Italy. Even policies required to resolve the crisis have been badly communicated, particularly the deal struck in October 2010 to include private creditors in sovereign debt restructurings. Regrettably, and to the consternation of jittery investors, the blunders are becoming more frequent at a time when the euro zone can least afford them. The growing likelihood of a Greek exit from the single currency bloc is fueling panic in the markets and increasing the risk of a self-fulfilling loss of confidence. This is because investors view developments in Athens through the prism of contagion to Spain and Italy. If ever there was a time for euro-zone leaders to say the right things, it is now. Yet rather than seeking to allay fears of contagion, policy makers are fueling them. This time it is the European Central Bank that is fanning investor concerns — not a good omen considering it is the only European institution the markets look to to shore up confidence. Not only are members of its governing council now talking openly about the possibility of an event they insisted was out of the question just weeks ago, they are even suggesting that a Greek exit would be containable. On May 12, Patrick Honohan, Ireland’s central bank governor, argued that a Greek withdrawal from the euro zone could be “technically” managed. A week later, his Belgian counterpart, Luc Coene, said that “an amicable divorce — if that was ever needed — would be possible.” Even Mario Draghi, the ECB’s president, conceded for the first time that Greece may leave the euro zone. For a scenario that the ECB only recently deemed “unthinkable” and whose consequences, it warned, were “incalculable,” these are striking admissions, and ones that carry big risks. The first is that, at such a politically and psychologically sensitive time in the euro-zone crisis, the markets take these statements as a sign that policy makers believe a Greek exit is now more or less inevitable.

Sunday 20 May 2012

Three killed in northern Italy earthquake

Three people have been killed in a 5.9-magnitude earthquake that struck northern Italy near Bologna, according to reports. The quake that struck at just after 4am local time was centred 21.75 miles north-northwest of Bologna at a relatively shallow depth of six miles, the US Geological Survey said. Italian news agency Ansa, citing emergency services, said two people were killed in Sant'Agostino di Ferrara when a ceramics factory collapsed. Another person was killed in Ponte Rodoni do Bondeno. In late January, A 5.4-magnitude quake shook northern Italy. Some office buildings in Milan were evacuated as a precaution and there were scattered reports of falling masonry and cracks in buildings. The tremor was one of the strongest to shake the region, seismologists said. Initial television footage indicated that older buildings had suffered damage. Roofs collapsed, church towers showed cracks and the bricks of some stone walls tumbled into the street during the quake. As dawn broke over the region, residents milled about the streets inspecting the damage. Italy's Sky TG24 showed images of the collapsed ceramics factory in Sant'Agostino di Ferrara where the two workers were reportedly killed. The structure, which appeared to be a hangar of sorts, had twisted metal supports jutting out at odd angles amid the mangled collapsed roof. The quake “was a strong one, and it lasted quite a long time”, said Emilio Bianco, receptionist at Modena's Canalgrande hotel, housed in an ornate 18th century palazzo. The hotel suffered no damage and Modena itself was spared, but guests spilled into the streets as soon as the quake hit, he said. Many people were still awake in the town since it was a “white night”, with shops and restaurants open all night. Museums were supposed to have remained open as well but closed following the bombing of a school in southern Italy that killed one person. The quake epicentre was between the towns of Finale Emilia, San Felice sul Panaro and Sermide, but was felt as far away as Tuscany and northern Alto Adige. The initial quake was followed about an hour later by a 5.1-magnitude aftershock, USGS said. And it was preceded by a 4.1-magnitude tremor. In late January, a 5.4-magnitude quake shook northern Italy. Some office buildings in Milan were evacuated as a precaution and there were scattered reports of falling masonry and cracks in buildings. In 2009, a devastating tremor killed more than 300 people in the central city of L'Aquila.

Friday 18 May 2012

Spain’s banking crisis reached Britain’s high streets last night when the credit rating of Santander UK was cut.

In a sweeping reassessment, ratings agency Moody’s announced in Madrid that it is downgrading 16 Spanish banks because it could not be sure of the ability of the country’s government to provide the necessary support.

Santander UK was among the banks highlighted after the ratings agency took aim at its parent Banco Santander, based in Spain.

The Spanish banking crisis has hit the British high street, with the news that Santander has had its credit rating cut

Santander is one of the biggest players in UK retail banking, having taken over the former Abbey National, Alliance & Leicester, Bradford & Bingley and most recently the English branches of the Royal Bank of Scotland.

The new lower A2 credit rating is certain to be a cause of anxiety to Santander UK’s millions of British customers.

Nevertheless, they can be confident that their deposits up to £85,000 are guaranteed by the British government should there be a loss of confidence.

Thursday 17 May 2012

'Queen of Disco' Donna Summer 'thought she became ill after inhaling 9/11 particles'

The 63-year-old singer, who had hits including Hot Stuff, Love to Love You, Baby and I Feel Love, died in Florida on Thursday morning. She had largely kept her battle with lung cancer out of the public eye. But the website TMZ reported that the singer had told friends she believed her illness was the result of inhaling toxic dust from the collapsed Twin Towers. On Thursday night tributes were paid to the singer, considered by many to be the voice of the 1970s. A statement released on behalf of her family — husband Bruce Sudano, their daughters Brooklyn and Amanda, her daughter, Mimi from a previous marriage and four grandchildren — read: “Early this morning, surrounded by family, we lost Donna Summer Sudano, a woman of many gifts, the greatest being her faith. "While we grieve her passing, we are at peace celebrating her extraordinary life and her continued legacy.

Investigators are questioning Mexico's former deputy defence minister and a top army general for suspected links to organised crime

Investigators are questioning Mexico's former deputy defence minister and a top army general for suspected links to organised crime, in the highest level scandal to hit the military in the five-year-old drug war.

Mexican soldiers on Tuesday detained retired general Tomás Angeles Dauahare and general Roberto Dawe González and turned them over to the country's organised crime unit, military and government officials said.

Angeles Dauahare was number 2 in the armed forces under President Felipe Calderón and helped lead the government's crackdown on drug cartels after soldiers were deployed to the streets in late 2006. He retired in 2008.

Dawe González, still an active duty general, led an elite army unit in the western state of Colima and local media said he previously held posts in the violent states of Sinaloa and Chihuahua.

An official at the attorney general's office said they would be held for several days to give testimony and then could be called in front of a judge.

"The generals are answering questions because they are allegedly tied to organised crime," the official said.

Angeles Dauahare said through a lawyer that his detention was unjustified, daily Reforma newspaper reported.

If the generals were convicted of drug trafficking, it would mark the most serious case of military corruption during Calderón's administration.

"Traditionally the armed forces had a side role in the anti-drug fight, eradicating drug crops or stopping drug shipments," said Alejandro Hope, a security analyst who formerly worked in the government intelligence agency.

"After 2006, they were more directly involved in public security, putting them at a higher risk of contact [with drug gangs]," he said.

About 55,000 people have been killed in drug violence over the past five years as rival cartels fight each other and government forces.

Worsening drug-related attacks in major cities are eroding support for Calderón's conservative National Action Party, or PAN, ahead of a 1 July presidential vote.

Over the weekend, police found 49 headless bodies on a highway in northern Mexico, the latest in a recent series of brutal massacres where mutilated corpses have been hung from bridges or shoved in iceboxes.

Opinion polls show Calderón's party is trailing by double digits behind opposition candidate Enrique Peña Nieto from the Institutional Revolutionary Party, or PRI, which says the government's drug strategy is failing.

Traditionally, the military has been seen as less susceptible to cartel bribes and intimidation than badly paid local and state police forces, who are often easily swayed by drug gang pay offs.

But there have been cases of military corruption in the past. Angeles Dauahare himself oversaw the landmark trial of two generals convicted of working with drug gangs in 2002.

Those two generals were convicted of links to the Juárez cartel once headed by the late Amado Carrillo Fuentes, who was known as the Lord of the Skies for flying plane load of cocaine into the United States.

Since then, the Sinaloa cartel - headed by Mexico's most wanted man Joaquín "Shorty" Guzmán - has expanded its power and is locked in a bloody battle over smuggling routes with the Zetas gang, founded by deserters from the Mexican army.

JPMorgan's Trading Loss Is Said to Rise at Least 50%

The trading losses suffered by JPMorgan Chase have surged in recent days, surpassing the bank’s initial $2 billion estimate by at least $1 billion, according to people with knowledge of the losses. When Jamie Dimon, JPMorgan’s chief executive, announced the losses last Thursday, he indicated they could double within the next few quarters. But that process has been compressed into four trading days as hedge funds and other investors take advantage of JPMorgan’s distress, fueling faster deterioration in the underlying credit market positions held by the bank. A spokeswoman for the bank declined to comment, although Mr. Dimon has said the total paper trading losses will be volatile depending on day-to-day market fluctuations. The Federal Reserve is examining the scope of the growing losses and the original bet, along with whether JPMorgan’s chief investment office took risks that were inappropriate for a federally insured depository institution, according to several people with knowledge of the examination. They spoke on the condition of anonymity because the investigation is still under way. The overall health of the bank remains strong, even with the additional losses, and JPMorgan has been able to increase its stock dividend faster than its rivals because of stronger earnings and a more solid capital buffer. Still, the huge trading losses rocked Wall Street and reignited the debate over how tightly giant financial institutions should be regulated. Bank analysts say that while the bank’s stability is not threatened, if the losses continue to mount, the outlook for the bank’s dividend will grow uncertain. The bank’s leadership has discussed the impact of the losses on future earnings, although a dividend cut remains highly unlikely for now. In March, the company raised the quarterly dividend by 5 cents, to 30 cents, which will cost the bank about $190 million more this quarter. A spokeswoman for the bank said a dividend cut has not been discussed internally. At the bank’s annual meeting in Tampa, Fla., on Tuesday, Mr. Dimon did not definitively rule out cutting the dividend, although he said that he “hoped” it would not be cut. John Lackey, a shareholder from Richmond, Va., who attended the meeting precisely to ask about the dividend, was not reassured. “That wasn’t a very clear answer,” he said of Mr. Dimon’s response. “I expect that shareholders are going to suffer because of this.” Analysts expect the bank to earn $4 billion in the second quarter, factoring in the original estimated loss of $2 billion. Even if the additional trading losses were to double, the bank could still earn a profit of $2 billion. And many analysts and investors remain optimistic about the bank’s long-term prospects. Glenn Schorr, a widely followed analyst with Nomura, reiterated on Wednesday his buy rating on JPMorgan shares, which are down more than 10 percent since the trading loss became public last week. What’s more, the chief investment office earned more than $5 billion in the last three years, which leaves it ahead over all, even given the added red ink. But the underlying problem is that while these sharp swings are expected at a big hedge fund, they should not be occurring at a bank whose deposits are government-backed and which has access to ultralow cost capital from the Federal Reserve, experts said. “JPMorgan Chase has a big hedge fund inside a commercial bank,” said Mark Williams, a professor of finance at Boston University, who also served as a Federal Reserve bank examiner. “They should be taking in deposits and making loans, not taking large speculative bets.” Not long after Mr. Dimon’s announcement of a dividend increase in March, the notorious bet by JPMorgan’s chief investment office began to fall apart. Traders at the unit’s London desk and elsewhere are now frantically trying to defuse the huge bet that was built up over years, but started generating erratic returns in late March. After a brief pause, the losses began to mount again in late April, prompting Mr. Dimon’s announcement on May 10. Beginning on Friday, the same trends that had been causing the losses for six weeks accelerated, since traders on the opposite side of the bet knew the bank was under pressure to unwind the losing trade and could not double down in any way. Another issue is that the trader who executed the complex wager, Bruno Iksil, is no longer on the trading desk. Nicknamed the London Whale, Mr. Iksil had a firm grasp on the trade — knowledge that is hard to replace, even though his anticipated departure is seen as sign of the bank’s taking responsibility for the debacle. “They were caught short,” said one experienced credit trader who spoke on the condition of anonymity because the situation is still fluid. The market player, who does not stand to gain from JPMorgan’s losses and is not involved in the trade, added, “this is a very hard trade to get out of because it’s so big.” He estimated that the initial loss of just over $2 billion was caused by a move of a quarter percentage point, or 25 basis points, on a portfolio with a notional value of $150 billion to $200 billion — in other words, the total value of the contracts traded, not JPMorgan’s exposure. In the four trading days since Mr. Dimon’s disclosure, the market has moved at least 15 to 20 basis points more against JPMorgan, he said. The overall losses are not directly proportional to the move in basis points because of the complexity of the trade. Many of the positions are highly illiquid, making them difficult to value for regulators and the bank itself. In its simplest form, traders said, the complex position assembled by the bank included a bullish bet on an index of investment-grade corporate debt, later paired with a bearish bet on high-yield securities, achieved by selling insurance contracts known as credit-default swaps. A big move in the interest rate spread between the investment grade securities and risk-free government bonds in recent months hurt the first part of the bet, and was not offset by equally large moves in the price of the insurance on the high yield bonds. As the credit yield curve steepened, the losses piled up on the corporate grade index, overwhelming gains elsewhere on the trades. Making matters worse, there was a mismatch between the expiration of different instruments within the trade, increasing losses. The additional losses represent a worsening of what is already the most embarrassing misstep for JPMorgan since Mr. Dimon became chief executive in 2005. No one has blamed Mr. Dimon for the trade, which was under the oversight of the head of the chief investment office, Ina Drew, but he has repeatedly apologized, calling it “stupid” and “sloppy.” Ms. Drew resigned Monday and more departures are anticipated.

Sunday 6 May 2012

Markets braced for shift away from austerity as Francois Hollande wins French election

A confrontation between the new president and Angela Merkel, Germany's chancellor, is also high on the markets' worry list. However leading economists believe Mr Hollande will attempt a damage limitation exercise to avoid increasing turmoil in a eurozone facing further upheavals, with the result of this weekend's Greek election increasing speculation about an eventual break-up of the fragile currency bloc. Mr Hollande's 'farewell to austerity' programme, which combines taxing the rich, raising public spending and lowering the retirement age, has raised the expectations of the French electorate about the end of the 'Merkozy' era. But Ms Merkel is unlikely to cede ground in the face of Mr Hollande's demand for a re-writing of the eurozone fiscal pact. Christian Jimenez, a fund manager at Diamant Bleu Gestion in Paris, said: "Hollande's victory has already been priced in by markets, however his promises made during the campaign have not been priced in, so there is risk on the downside if he stands his ground when he announces a first set of measures. "There's a clear need to boost economic growth across Europe, no question, but the debate is on how to achieve that without spooking investors. All in all, Hollande won't be able to convince Merkel to soften her position on the need for austerity."

Brink's Mat the reason that Great Train Robber was shot dead in Marbella

The Brink’s-Mat curse even touched on the Great Train Robbery gang of 1963. One of them, Charlie Wilson, found himself in trouble when £3 million of Brink’s-Mat investors’ money went missing in a drug deal. In April 1990, he paid the price when a young British hood knocked on the front door of his hacienda north of Marbella and shot Wilson and his pet husky dog before coolly riding off down the hill on a yellow bicycle.

Saturday 5 May 2012

British tourist falls to her death from hotel balcony in Magalluf

23 year old British tourist has fallen to her death from the third floor balcony of her hotel in Magalluf, Mallorca. Emergency sources said it happened at 4.25am Saturday morning at the Hotel Teix in Calle Pinada. Local police and emergency health services went to scene. After 20 minutes of an attempt to re-animate her heart, the woman was pronounced dead. Online descriptions for the Hotel say it is the best place to stay of you are looking for non-stop partying, adding it not suitable for families.

Friday 4 May 2012

Greek far-right parties could end up with as much as 20 percent of the vote in Sunday's elections. The neo-Nazi Golden Dawn party has intensified the xenophobic atmosphere in the country.

At night, the streets leading to Omonoia Square are empty. That wasn't always the case. The area was the premier multicultural neighborhood of Athens and one of the first quarters to be gentrified. Jazz bars and Indian restaurants lined the streets, separated by the occasional rooms-by-the-hour hotel. It was a quarter full of immigrants, drug addicts and African prostitutes, but also of journalists, ambitious young artists and teenagers from private schools. Today, the immigrants stay home once night falls. They are afraid of groups belonging to the "angry citizens," a kind of militia that beats up foreigners and claims to help the elderly withdraw money from cash machines without being robbed. Such groups are the product of an initiative started by the neo-Nazi Chrysi Avgi -- Golden Dawn -- the party which has perpetrated pogroms in Agios Panteleimon, another Athens neighborhood with a large immigrant population. There are now three outwardly xenophobic parties in Greece. According to recent surveys, together they could garner up to 20 percent of the vote in elections on Sunday: the anti-Semitic party LAOS stands to win 4 percent; the nationalist party Independent Greeks -- a splinter group of the conservative Nea Dimokratia party -- is forecast to win 11 percent; and the right extremists of Golden Dawn could end up with between 5 and 7 percent. My name is Xenia, the hospitable. Greece itself should really be called Xenia: Tourism, emigration and immigration are important elements of our history. But hospitality is no longer a priority in our country, a fact which the ugly presence of Golden Dawn makes clear. A Personal Attack Shaved heads, military uniforms, Nazi chants, Hitler greetings: How should a Greek journalist deal with such people? Should one just ignore them and leave them unmentioned? Should one denounce them and demand that they be banned? One shouldn't forget that they are violent and have perpetrated several attacks against foreigners and leftists. I thought long and hard about how to write about Golden Dawn so that my article was in no way beneficial to the party. On April 12, the daily Kathimerini ran my story under the headline "Banality of Evil." In the piece, I carefully explained why it was impossible to carry on a dialogue with such people and why I thought the neo-Nazi party should disappear from media coverage and be banned. Five days later, an anonymous reply to my article appeared on the Golden Dawn website. It was a 2,500-word-long personal attack in which the fascists recounted my entire career, mocked my alleged foreign roots (I was born in Hamburg) and even, for no apparent reason, mentioned my 13-year-old daughter. The unnamed authors indirectly threatened me as well: "To put it in the mother tongue of foreign Xenia: 'Kommt Zeit, kommt Rat, kommt Attentat!'" In other words, watch your back. Most Greeks believe that Golden Dawn has connections to both the police and to the country's secret service. Nevertheless, I went to the authorities to ask what I should do. I was told that I should be careful. They told me that party thugs could harass me, beat me or terrorize me over the phone. It would be better, they said, if I stopped writing about them. If I wished to react to the threats, they suggested I file a complaint against Golden Dawn's service provider. That, however, would be difficult given that the domain is based somewhere in the United States. Like Weimar Germany A friend told me that I should avoid wearing headphones on the street so that I can hear what is going on around me. My daughter now has nightmares about being confronted by members of Golden Dawn. Three of her classmates belong to the party. The three boys have posted pictures of party events on their Facebook pages. For their profile image, they have chosen the ancient Greek Meandros symbol, which, in the red-on-black manifestation used by Golden Dawn, resembles a swastika. The group's slogans include "Foreigners Out!" and "The Garbage Should Leave the Country!" The fact that immigration has become such an issue in the worst year of the ongoing economic crisis in the country can be blamed on the two parties in government. The Socialist PASOK and the conservative Nea Dimokratia (New Democracy, or ND) are running xenophobic campaigns. ND has said it intends to repeal a law which grants Greek citizenship to children born in Greece to immigrant parents. And cabinet member Michalis Chrysochoidis, of PASOK, has announced "clean up operations" whereby illegal immigrants are to be rounded up in encampments and then deported. When he recently took a stroll through the center of Athens to collect accolades for his commitment to the cause, some called out to him: "Golden Dawn has cleaned up Athens!" Yet, Chrysochoidis is the best loved PASOK politician in his Athens district, in part because of his xenophobic sentiments. His party comrade, Health Minister Andreas Loverdos, is just as popular. Loverdos has warned Greek men not to sleep with foreign prostitutes for fear of contracting HIV and thus endangering the Greek family. High unemployment of roughly 22 percent, a lack of hope, a tendency toward violence and the search for scapegoats: Analyses in the Greek press compare today's Greece with Germany at the end of the Weimar Republic. "We didn't know," said many Germans when confronted with the truth of the Holocaust after Nazi rule came to an end. After elections on May 6, no Greeks should be able to make the same claim.

Locked Up Abroad is different.

Reality TV is, at its core, about letting viewers revel in the bad decision-making of others: those who speak without thinking, who backstab, who have sex without condoms, who cheat. Frustratingly, though, reality shows—to which I am unapologetically addicted—tend to reward bad behavior, by giving its villains notoriety, spinoffs, opportunities to endorse weight-loss products, a nice sideline in paid interviews with supermarket tabloids, and other D-list rewards.

Locked Up Abroad is different. The National Geographic show, the sixth season of which premiered last week, gives its stars something they wouldn’t get on other reality shows: their comeuppance.

Having debuted in the U.K. (under the title Banged Up Abroad), Locked Up Abroad showcases one person (sometimes a couple) who ends up in prison overseas. Participants fit into one of two categories. The first group are the (largely) innocent: the married missionary couple who were kidnapped in the Philippines by the Islamist group Abu Sayyaf, for instance, or the seemingly goodhearted duo who wanted to help children in Chechnya, but ended up held hostage. These tales of the altruistic and naive can be difficult to watch.

But then there are those who rather deserve what happens to them. Typically these are drug smugglers, and their episodes follow a familiar arc. A young person—they’re almost always young—is bored or in need of cash (usually both). She is desperate or feels invincible (usually both). Someone approaches her and offers a seemingly great deal: an all-expenses-paid, luxurious overseas trip in exchange for a small favor. Sometimes the would-be employer is upfront and admits he needs a drug mule, but downplays the risk; other times, he hints at harmless-sounding illegalities, like bringing back legal goods to beat the export tax. In a few cases, the cover story is painfully thin: Come with me to check out this cool new nail polish technology only available in Thailand, for example. (That woman was in a vulnerable place: She had just been released on bail after killing her partner’s former husband—in self-defense, she claimed.)

The drug smugglers are caught, of course, usually at the airport, and brought to prison. And while a few episodes have taken place in developed countries—Spain, Japan, South Korea—the majority of our anti-heroes end up incarcerated in places with some of the dirtiest and most dangerous penitentiaries in the world.

Take last week’s episode, “From Hollywood to Hell.” (And pardon my spoilers, but this installment is too good not to describe in detail.) In 2001, actor Erik Aude was living the marginal Hollywood dream. An ür-bro, he had played bit parts in Dude, Where’s My Car?(credited as “Musclehead”) and 7th Heaven (“Boyfriend”) when a gym buddy asked him to go to Turkey to bring back “leather goods.” Aude makes the trip, and though a drug-sniffing dog alerts authorities at the Turkish airport, they find nothing—so Aude feels sure the whole thing is legit. He even recommends that one of his brothers start couriering for his friend. Then, when his brother backs out of a planned trip to Pakistan in 2002, Aude steps in, and shit gets real.

It is difficult to feel sorry for Aude. After his escort dumps him in an Islamabad hotel and warns him not to leave because the area is unsafe for Americans, he doesn’t head to the embassy or the airport. Instead, he goes jogging—and even tries to flirt with girls in headscarves on the street (with disastrous results). And when he is taken to the airport with just one suitcase, he is (he claims) not the least bit suspicious that he might be a drug mule. When a customs official asks him whether his trip was for business or pleasure, he cheeses, “Pleasure is my business.”

Aude’s episode is mind-bogglingly watchable, not least because he—of course!—plays himself in the re-enactment. In his telling, he was a virtual action star: On at least three occasions, he single-handedly fights back dozens of Pakistanis. After he takes out a prison bully, he is hailed a hero. He rejects a reduced sentence because it would require him to plead guilty—and his pride is more valuable than his freedom, he says.

Aside from those truly in the wrong place at the wrong time, the most sympathetic characters of Locked Up Abroad may be the embassy employees called in to assist the suspected smugglers. Inevitably, Locked Up Abroad participants are horrified that the embassies of their homelands—usually English-speaking countries like the U.S., the U.K., or Australia—can’t do more for them. I can just imagine U.S. Embassy workers calling “not it” every time they get word from local authorities about some young American knucklehead who thought he could sneak past security with a bag full of cocaine.

Tonight’s episode is called “The Juggler Smuggler,” and its “hero” is Mark Greening, a “party-loving” drug-runner who knows his latest trip is “doomed” when he doesn’t get his fortune told by “his favorite Gypsy woman.” I can’t wait.

Low fare airline bmibaby to close

Low fare carrier bmibaby is set to close later this year, threatening the loss of hundreds of jobs and the ending of its flights. The carrier transferred to International Airlines Group, the owners of British Airways, last month, but consultations have now started with unions about its closure in September. The GMB union said it was "devastating" news, especially for the East Midlands, where hundreds of jobs are now threatened with the axe. With bmi Regional, bmibaby transferred to International Airlines Group ownership on completion of the purchase from Lufthansa. IAG has consistently said that bmibaby and bmi Regional are not part of its long-term plans. A statement said: "Progress has been made with a potential buyer for bmi Regional, but so far this has not been possible for bmibaby, despite attempts over many months by both Lufthansa and IAG. Bmibaby has therefore started consultation to look at future options including, subject to that consultation, a proposal to close in September this year." Peter Simpson, bmi interim managing director, said: "We recognise that these are unsettling times for bmibaby employees, who have worked tirelessly during a long period of uncertainty. Bmibaby has delivered high levels of operational performance and customer service, but has continued to struggle financially, losing more than £100 million in the last four years. In the consultation process, we will need to be realistic about our options. "To help stem losses as quickly as possible and as a preliminary measure, we will be making reductions to bmibaby's flying programme from June. We sincerely apologise to all customers affected and will be providing full refunds and doing all we can with other airlines to mitigate the impact of these changes." Jim McAuslan, general secretary of the pilots' union Balpa, said: "This is bad news for jobs. Bmibaby pilots are disappointed and frustrated that, even though there appears to be potential buyers, we are prevented from speaking with them to explore how we can contribute to developing a successful business plan. "The frustration has now turned to anger following the news that Flybe (which is part owned by BA) has moved onto many of these bmibaby routes without any opportunity for staff to look at options and alternatives. Balpa's priority is to protect jobs; and we will use whatever means we can to do so." The changes mean that all bmibaby flights to and from Belfast will cease from June 11, although this will not affect bmi mainline's services to London Heathrow. Bmibaby services from East Midlands to Amsterdam, Paris, Geneva, Nice, Edinburgh, Glasgow and Newquay, and from Birmingham to Knock and Amsterdam, will end on the same date.

Wednesday 25 April 2012

Insecure websites to be named and shamed after checks

Companies that do not do enough to keep their websites secure are to be named and shamed to help improve security. The list of good and bad sites will be published regularly by the non-profit Trustworthy Internet Movement (TIM). A survey carried out to launch the group found that more than 52% of sites tested were using versions of security protocols known to be compromised. The group will test websites to see how well they have implemented basic security software. Security fundamentals The group has been set up by security experts and entrepreneurs frustrated by the slow pace of improvements in online safety. "We want to stimulate some initiatives and get something done," said TIM's founder Philippe Courtot, serial entrepreneur and chief executive of security firm Qualys. He has bankrolled the group with his own money. TIM has initially focused on a widely used technology known as the Secure Sockets Layer (SSL). Experts recruited to help with the initiative include SSL's inventor Dr Taher Elgamal; "white hat" hacker Moxie Marlinspike who has written extensively about attacking the protocol; and Michael Barrett, chief security officer at Paypal. Continue reading the main story “ Start Quote Everyone is now going to be able to see who has a good grade and who has a bad grade” Philippe Courtot Many websites use SSL to encrypt communications between them and their users. It is used to protect credit card numbers and other valuable data as it travels across the web. "SSL is one of the fundamental parts of the internet," said Mr Courtot. "It's what makes it trustworthy and right now it's not as secure as you think." Compromised certificates TIM plans a two-pronged attack on SSL. The first part would be to run automated tools against websites to test how well they had implemented SSL, said Mr Courtot. "We'll be making it public," he added. "Everyone is now going to be able to see who has a good grade and who has a bad grade." Early tests suggest that about 52% of sites checked ran a version of SSL known to be compromised. Companies who have done a bad job will be encouraged to improve and upgrade their implementations so it gets safer to use those sites. The second part of the initiative concerns the running of the bodies, known as certificate authorities, which guarantee that a website is what it claims to be. TIM said it would work with governments, industry bodies and companies to check that CAs are well run and had not been compromised. "It's a much more complex problem," said Mr Courtot. In 2011, two certificate authorities, DigiNotar and GlobalSign were found to have been compromised. In some cases this meant attackers eavesdropped on what should have been a secure communications channel. Steve Durbin, global vice president of the Information Security Forum which represents security specialists working in large corporations, said many of its members took responsibility for making sure sites were secure. "You cannot just say 'buyer beware'," he said. "That's not good enough anymore. They have a real a duty of care." He said corporations were also increasingly conscious of their reputation for providing safe and secure services to customers. Data breaches, hack attacks and poor security were all likely to hit share prices and could mean they lose customers, he noted.

Anti-depressants likely do more harm than good, study suggests

Commonly prescribed anti-depressants appear to be doing patients more harm than good, say researchers who have published a paper examining the impact of the medications on the entire body. See Also: Health & Medicine Pharmacology Birth Defects Mental Health Research Mind & Brain Depression Disorders and Syndromes Psychiatry Reference COX-2 inhibitor Psychoactive drug Seasonal affective disorder Anti-obesity drug "We need to be much more cautious about the widespread use of these drugs," says Paul Andrews, an evolutionary biologist at McMaster University and lead author of the article, published recently in the online journal Frontiers in Psychology. "It's important because millions of people are prescribed anti-depressants each year, and the conventional wisdom about these drugs is that they're safe and effective." Andrews and his colleagues examined previous patient studies into the effects of anti-depressants and determined that the benefits of most anti-depressants, even taken at their best, compare poorly to the risks, which include premature death in elderly patients. Anti-depressants are designed to relieve the symptoms of depression by increasing the levels of serotonin in the brain, where it regulates mood. The vast majority of serotonin that the body produces, though, is used for other purposes, including digestion, forming blood clots at wound sites, reproduction and development. What the researchers found is that anti-depressants have negative health effects on all processes normally regulated by serotonin. The findings include these elevated risks: developmental problems in infants problems with sexual stimulation and function and sperm development in adults digestive problems such as diarrhea, constipation, indigestion and bloating abnormal bleeding and stroke in the elderly The authors reviewed three recent studies showing that elderly anti-depressant users are more likely to die than non-users, even after taking other important variables into account. The higher death rates indicate that the overall effect of these drugs on the body is more harmful than beneficial. "Serotonin is an ancient chemical. It's intimately regulating many different processes, and when you interfere with these things you can expect, from an evolutionary perspective, that it's going to cause some harm," Andrews says. Millions of people are prescribed anti-depressants every year, and while the conclusions may seem surprising, Andrews says much of the evidence has long been apparent and available. "The thing that's been missing in the debates about anti-depressants is an overall assessment of all these negative effects relative to their potential beneficial effects," he says. "Most of this evidence has been out there for years and nobody has been looking at this basic issue." In previous research, Andrews and his colleagues had questioned the effectiveness of anti-depressants even for their prescribed function, finding that patients were more likely to suffer relapse after going off their medications as their brains worked to re-establish equilibrium. With even the intended function of anti-depressants in question, Andrews says it is important to look critically at their continuing use. "It could change the way we think about such major pharmaceutical drugs," he says. "You've got a minimal benefit, a laundry list of negative effects -- some small, some rare and some not so rare. The issue is: does the list of negative effects outweigh the minimal benefit?"

Madeleine McCann, the British girl who went missing while on holiday in Portugal half a decade ago, could still be alive, Scotland Yard said on Wednesday.

Detectives released a new “age progression” image of the toddler, which they said showed what she would look like today at the age of nine.

On Wednesday, Britain’s biggest police force said that as a result of evidence uncovered during a review “they now believe there is a possibility Madeleine is still alive”.

Officers have so far identified nearly 200 new items for investigation within historic material and are also “developing what they believe to be genuinely new material”.

Scotland Yard urged Portuguese authorities to reopen the search for her amid the new "investigative opportunities".

Police said the image, created ahead of what would have been her ninth birthday on May 12, had been created in “close collaboration with the family”.

Dengue Fever Asian Mosquito Could Invade UK

The mosquito can carry dengue and chikungunya viruses

A mosquito that spreads tropical diseases including dengue fever may be poised to invade the UK because of climate change.

The Asian tiger mosquito has already been reported in France and Belgium and could be migrating north as winters become warmer and wetter.

Scientists have urged "wide surveillance" for the biting insect across countries of central and northern Europe, including the UK.

The mosquito can carry dengue and chikungunya viruses, both of which cause high fevers. The infections usually occur in tropical regions of Africa, Asia and South America.

Scientists led by Dr Samantha Martin, from the University of Liverpool, used climate models to predict how changing conditions might affect Asian tiger mosquito distribution.

They wrote in the Journal of the Royal Society Interface: "Mosquito climate suitability has significantly increased over the southern UK, northern France, the Benelux, parts of Germany, Italy, Sicily and the Balkan countries."

The research shows that parts of the UK could become hot-spots of Asian tiger mosquito activity between 2030 and 2050.

The mosquito has been introduced into Europe from Asia via goods shipments, mainly used tyres and bamboo.

Climate change is now shifting conditions suitable for the insect from southern Europe to central north-western areas.

The mosquito could survive in water butts and vases, and may find winter protection in greenhouses, said the researchers.

Saturday 21 April 2012

Britons living overseas defrauded 43 million pounds in benefit fraud in 2011

The British Secretary of State for Work and Pensions, Iain Duncan Smith, has been visiting the Department of Work and Pensions benefits and healthcare team in Madrid. He warned Britons living abroad not to break the strict rules on what benefits they can and cannot claim. People who are pretending to live in the UK so they can collect benefits, but in fact are living overseas cost the British taxpayer 43 million pounds last year. Most of the reports of such benefit fraud came from Spain. Iain Duncan Smith commented, “We are determined to clamp down on benefit fraud abroad, which cost the British taxpayer around £43 million last year. This money should be going to the people who need it most and not lining the pockets of criminals sunning themselves overseas. The vast majority of British people overseas are law abiding, but fraudulently claiming benefits while living abroad is a crime and we are committed to putting a stop to it.” He also encouraged Britons to use the dedicated Spanish hotline to report benefit thieves. 900 554 440 or you report a benefit fraud here. The hotline has resulted in 100 people being sanctioned or prosecuted, and 134 more cases are currently under investigation. 3.1 million pounds in over payments of benefit have been identified and will be reclaimed. Source – UK in Spain - http://ukinspain.fco.gov.uk/en/news/?view=News&id=754530182 Duncan Smith made the most of his visit to Madrid and took the chance to meet with Health Minister, Ana Mato, and the Mayor of Madrid, Ana Botella. They discussed the response to the crisis with Duncan Smith calling for an end to the culture of ‘unemployment and dependency’, increasing the control on public spending and eliminating ‘the subsidies which don’t resolve problems because in some cases ‘they trap the poor’.

Anti-Corruption prosecutors to be strengthened in Málaga

The State Attorney General, Eduardo Torres-Dulce, has said that there are plans to designate ‘one or two prosecutors’ more to the specialist Anti-Corruption section in the province of Málaga. He made the comment at an event where Juan Carlos López Caballero took possession as Chief Prosecutor for Málaga, a job which he was sharing with his post as Delegate from the Anti-Corruption Prosecutor, where three prosecutors work. There have been complaints from prosecutors that only 8% of civil servants who work for the administration of justice do so in the prosecutors’ office, a number described as ‘totally insufficient’.

Health Minister announces crackdown on foreigners using the Spanish Health Service

The cabinet on Friday decided to crack down on foreigners using the Spanish Health Service as part of an additional 7 billion € of cuts. They intend to toughen the conditions for inclusion on the Padrón census. Minister for Health, Ana Mato, said ‘We are going to end the abuses committed by some foreigners’. She is going to change the Ley de Extranjería which intends to put a limit to the so-called ‘health tourism’, which has seen family members of foreign residents to come to Spain ‘exclusively’ to receive health attention. Ana Mato insisted that from now it will not be so easy to come to Spain, sign the Padrón census, and obtain a health card, as it has been. ‘Just getting on the Padrón they all had the right to the health card’, said the Minister. ‘Now there will be a series of additional requirements when the Padrón is issued’. She said to guarantee the universality of the Health Service ‘for all the Spaniards’ it was necessary to stop the illegal and undue use which some foreigners have been making of this service. On Thursday the Minister met with the regions and they agreed on a new article which will ‘explicitly prohibit a person moving regions in search of health attention'. The Minister considers these measures will do away with health tourism and save 1 billion €. Ana Mato also said that she was going to revise some international conventions on the matter, given that ‘many’ countries do not repay the money they owe Spain for the health attention given here to their citizens. Among the other measures approved, the end of paying for some medicaments ‘with little therapeutic value’. A list of included medicines accepted nationally is to be prepared. The Minister said ‘We all have to collaborate with those who having a worse time’.

Ryanair threatens surcharge on flights to Spain

Millions of its passengers – who have already booked and paid for their flights in full – may now be asked to pay an extra fee upon departure, or be told they are not allowed to board. The airline sent an email to customers this week warning them of the backdated fare. “We may be forced to debit passengers for any government imposed increases in airport charges prior to your travel date,” its message read. “If any such tax, fee or charge is introduced or increased after your reservation has been made you will be obliged to pay it (or any increase) prior to departure”.

Friday 20 April 2012

France and Germany want to suspend the Shengen Agreement

They say they want a temporary suspension while the crisis continues. Spain will being introducing border restrictions during the European Central Bank meeting in Barcelona at the start of May.Angela Merkel and Nicolás Sarkozy - The Interior Ministers of France and Germany have written a joint letter in which they call for the reform of, and ‘temporary suspension’ of the Schengen agreement which allows for the free movement between most member states of the EU. They say the change is necessary ‘to control the massive flow of immigrants’. The call comes just ahead of the 25th anniversary of the treaty this coming Monday, although many countries signed up in March 1995. France and Germany consider that a ‘temporary suspension’ is needed during the crisis, and Paris and Berlin speak of ‘provisional’ closure of frontiers, and only when a country in the Schengen space cannot control the flow of immigrants. They say they will give the details to their European partners at the next conference. Meanwhile Spain has announced the suspension of the Schengen Treaty and the re-establishing of frontier controls with France ahead of the European Central Bank meeting which is to be held in Barcelona on May 3. It has not yet been decided how long the border restriction will remain in place, but say it will allow the authorities to act if there is ‘a serious threat to public order or interior security’. The measure will only affect the frontiers between Spain and France from the Basque Country to Cataluña. Reports indicate that it was the Catalan Government to step up the controls in the face of possible disturbances and the arrival of anti-system protestors from other countries in Europe.

Thursday 19 April 2012

British police arrested three people, including the royal editor of Rupert Murdoch's Sun tabloid

British police arrested three people, including the royal editor of Rupert Murdoch's Sun tabloid, a source familiar with the situation said, in an escalation of a long-running phone hacking scandal which reaches into Britain's political establishment.

Thursday's arrests and the fact they stemmed from information given to the police by Murdoch's company itself is likely to reignite tensions within the media group, just days before parliament gives its verdict on how the culture of illegality came about.

Next week Rupert Murdoch and son James will also appear before a judicial inquiry to answer questions over the conduct of the press, which will focus on the close ties between Murdoch, his executives and the political establishment.

James Murdoch will appear in court room 73 at the Royal Courts of Justice on Tuesday while lawyers at the inquiry have cleared a day and a half to grill the 81-year-old Rupert on Wednesday and Thursday.

"This was always going to be an important six weeks in this affair, with the Murdochs and politicians going before the Leveson judicial inquiry, but it will be exacerbated by the arrests and the imminent committee report," said Steven Barnett, communications professor at the University of Westminster.

Police made the arrests one day after prosecutors confirmed they had started to examine the police case against four journalists and seven others to establish whether they should be charged with a range of offences including perverting the course of justice.

Press reports have speculated that one of those named in the files is Rebekah Brooks, a former editor of the News of the World and Sun tabloids and a close friend of both Murdochs and Prime Minister David Cameron.

Brooks has been arrested twice, once for corruption and intercepting communications, and more recently for perverting the course of justice, along with her husband, Charlie Brooks.

The three arrested on Thursday were detained at dawn and questioned over inappropriate payments made to police and public officials.

The source familiar with the situation said one of those was Duncan Larcombe, royal editor and a former defence correspondent at the Sun, Britain's biggest selling daily newspaper.

A spokeswoman for Murdoch's British newspaper arm News International confirmed that one of those arrested was a Sun journalist but declined to give further details.

Larcombe was previously a defence correspondent at the Sun and another person arrested on Thursday was described by police as a 42-year-old former member of the armed forces. A woman aged 38 has also been arrested on suspicion of aiding and abetting misconduct in a public office.

ROUTINE HACKING

Murdoch's British newspaper arm has been rocked in the last year by allegations that journalists at the Sun's sister title, the News of the World, had routinely hacked into phones to generate salacious front-page stories.

The police investigation, which forced the closure of the 168-year-old News of the World, has since moved on to the Sun newspaper and whether its journalists paid police and public officials for stories.

While damaging the reputation of Murdoch, the intense spotlight has also revealed the extremely close links he and his executives have with politicians and senior police officers, embarrassing many with tales of horse rides and Christmas drinks between the upper echelons of Murdoch executives and politicians.

Police said the latest arrests were prompted by information provided by the Management and Standards Committee, a small team set up by Murdoch's News Corp to co-operate closely with the police in a move that has infuriated newspaper staff.

The 81-year-old Murdoch was forced to travel to London in February to reassure journalists of his commitment to the Sun after a string of earlier arrests caused a showdown at the paper by staff who felt they had been abandoned by their management.

Since then, the Sun has launched a Sunday version and both the Sun and Murdoch's Times newspaper have noticeably hardened their position towards the government, which turned on Murdoch at the height of the hacking scandal last year.

That antagonism is likely to be exacerbated in the coming weeks when the parliamentary select committee, which summoned James and Rupert Murdoch at the height of the scandal last year, publishes its findings.

The committee investigated allegations of phone hacking after they first surfaced in 2006 and it has since looked at whether it was misled in its initial inquiry by a host of News International executives who pleaded innocence.

Paul Farrelly, a leading member of the committee, told Reuters they hoped to publish the long-awaited report by May 1.

Tom Watson, a member of the committee who has campaigned against Murdoch, told reporters he thought News Corp had become a toxic institution which operated like a shadow state

Wednesday 18 April 2012

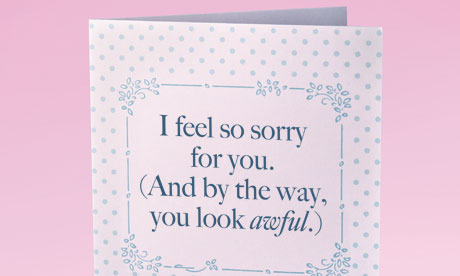

10 things not to say to someone when they're ill

What no one ever tells you about serious illness is that it places you at the centre of a maelstrom of concerned attention from family and friends. Of course it does. That's one of the nice things. It's actually the only nice thing. But it's also a rather tricky challenge, at a time when you may feel – just slightly – that you have enough on your plate. Suddenly, on top of everything else, you are required to manage the emotional requirements of all those who are dear to you, and also, weirdly, one or two people who you don't see from one year to the next, but who suddenly decide that they really have to be at your bedside, doling out homilies, 24 hours a day. It's lovely to hear from people when you're ill. But it's also lovely when they add: "No need to reply." The biggest shock, when I was diagnosed with cancer the summer before last, was quickly observing that people can be quite competitive in their determination to "be there for you", and occasionally unable to hide their chagrin when some other chum has been awarded a particularly sensitive role at a particularly sensitive medical consultation. Nobody means to be intrusive or irritating. It's all done with the finest intentions. But, God, it's a pain. Yet by not saying 10 simple things, you too, can be the friend in need that you want to be.

1 "I feel so sorry for you"

It's amazing, the number of people who imagine that it feels just great to be the object of pity. Don't even say "I feel so sorry for you" with your eyes. One of my friends was just brilliant at mimicking the doleful-puppy-poor-you gaze, and when I had been subjected to a sustained bout of it, I used to crawl over to the local pub for lunch with him, just so that he could make me laugh by doing it. Don't say "I feel so sorry for you" with your hand either. When someone patted my thigh, or silently rested their paw on it, often employing the exasperating form of cranial communication known as "sidehead" at the same time, I actually wanted to deck them. Do say: "I so wish you didn't have to go through this ghastly time." That acknowledges that you are still a sentient being, an active participant in your own drama, not just, all of a sudden, A Helpless Victim.

2 "If anyone can beat this, it's you"

Funnily enough, it's not comforting to be told that you have to go into battle with your disease, like some kind of medieval knight on a romantic quest. Submitting to medical science, in the hope of a cure, is just that – a submission. The idea that illness is a character test, with recovery as a reward for the valiant, is glib to the point of insult. Do say: "My mum had this 20 years ago, and she's in Bengal now, travelling with an acrobatic circus." (Though not if that isn't true.)

3 "You're looking well"

One doesn't want to be told that one's privations are invisible to the naked eye. Anyway, one is never too ill to look in a mirror, and see a great big moon-face, bloated with steroids and sporting the bright red panda eyes that are triggered by that most aggressive and efficient of breast-cancer drugs, Docetaxel. I knew I looked like death warmed up, not least because I felt like death warmed up. Nobody wants to be patronised with ridiculous lies. They are embarrassing for both speaker and listener. If your sick pal wants to discuss her appearance, she'll ask you what you reckon. It'll be a leading question, so take your cue from her.

4 "You're looking terrible"

I know it sounds improbable. But people really did feel the need to reassure me that my hideousness was plain to see. One person told me that while I'd put on a lot of weight, I'd of course be able to go on a diet as soon as I was better. I wouldn't have minded quite so much, if she hadn't arrived bearing a giant mound of snacks and cakes, a great, indiscriminate pile of stuff that suggested she'd been awarded four minutes in Whole Foods by Dale Winton, in a nightmarish haute-bourgeois version of Supermarket Sweep. And, in fact, I haven't gone on a diet. Somehow, being a size 10 doesn't seem tremendously importantany longer. On the other hand, when I said: "Don't I look monstrous?" I was asking people to help me to laugh at myself – which many did – and to tell me that this too would pass. One of my friends took photographs of me, behind a curtain in the hospital, looking comically interfered with by surgeons, and festooned with tubes and drains full of bloody fluid. We laughed so much that I probably came nearer to death right then than at any other point.

5 "Let me know the results"

Oddly, one doesn't particularly want to feel obliged to hit the social networks the moment one returns from long, complicated, stressful and invasive tests, which ultimately delivered news you simply didn't want to hear. Of course, this request is made because people are worried. But, a bit of worry is easier to bear than the process of coming to terms with news that confirms another round of debilitating, soul-crushing treatment. If people do want to talk about such matters, they really need to be allowed some control over when, how and to whom. Contacting their very nearest and dearest instead is fine, as is volunteering to spread the bad tidings to others who are also anxious.

6 "Whatever I can do to help"

Apart from anything else, it's boring. Everybody says it, even though your assumption tends to be that people do want to help, of course. That doesn't mean that help should not be offered. But "Can I pick the children up from school on Tuesdays?" or "Can I come round with a fish pie and a Mad Men box set?" is greatly preferable to: "Can I saddle you with the further responsibility of thinking up a task for me?" If you do happen to be on the receiving end of "whatever I can do to help", be shameless. Delegate with steely and ruthless intent.

7 "Oh, no, your worries are unfounded"